Are you paying too much in investment fees? Probably.

That is, and per research from Questrade and as further discussed in this article from Moneysense, Canadians are still paying too much in investment fees. The Questrade survey found that 87% of Canadians either don’t know or underestimate the difference that a 2% or 1% fee has on their portfolios over the long run (of 20-plus years).

We've all seen the TV ads too. You know, those smug and smarmy investors talking about fees with their brother, friend, or parent and how it can mean a 30% difference to your portfolio value in retirement. The truth is...this is not far off.

Let's use an example to illustrate

Jim is 40, single, and earns $95,000 per year. Jim has managed to save $130,000 in his RRSP and $30,000 in his TFSA. Jim is also disciplined and plans to save $1000 per month to his RRSP and $500 per month to his TFSA until his planned retirement at age 65. At retirement, Jim hopes to have a $5000 per month spending budget. Like many Canadians, Jim has consulted with his bank advisor and has both the RRSP and TFSA accounts invested in a "growth" mutual fund through the bank. We have pegged this fund to earn 5.58% per year before fees.

What Jim does not know, is that the mutual fund also has a management expense ratio, or MER, of 1.5%. A MER is the combined costs of managing a fund and is embedded into the funds overall results. It's quite common in Canada for mutual funds to have MERs in the 1% to 2.5% range and so for our example, use of a MER at 1.5% is a touch on the low side.

Now as luck would have it, Jim hears a co-worker talking about index-based exchange traded funds (ETFs) which includes a "growth" ETF that seems remarkably similar to Jim's mutual fund. It has the same 5.58% return but, as his co-worker carefully explains, the MER is only 0.25%. His co-worker also tells Jim that she does pay an additional fee to a fee-for-service financial planner that she figures adds about another 0.25% worth of fees per year for a grand total of 0.5% of combined advice and investment fees.

This gets Jim wondering what he pays for fees and so he digs deeper into his mutual fund brochure (often called a prospectus) and discovers the 1.5% MER. Jim also contemplates the fact that he doesn't really get any actual financial advice from his bank. Jim is concerned about all of this and so he takes a bold step...he decides to visit an independent fee-for-service financial planner. He tells the planner everything about his situation, his goals, and what his co-worker told him. The planner scratches her chin and nods sagely.

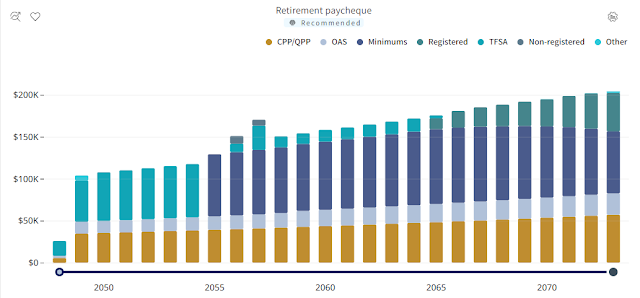

The planner then crunches the numbers including the use of Jim's mutual fund as the primary investment vehicle. Jim sees that his assets at age 65 include $854,000 in RRSPs and $316,000 in his TFSA. Not bad, but as his planner points out, this is still only 85% of the way to his retirement goal and he still runs out of money in his 80s. Not cool.

Next, the planner says, let's change nothing else except to replace the mutual fund with the growth ETF at 0.25%. Jim is very impressed with the planner and asks that she also keep another 0.25% in advice fees in the plan just in case. This makes his total investment fee burden 0.5% instead of the 1.5% he was paying to his mutual fund.

Jim is blown away by the change in numbers. At age 65 he now has $1,043,314 in his RRSP and $382,991 in his TFSA. Collectively, that is over $256,000 more than with the mutual fund. Jim's retirement plan is now on track at 112% of plan and he never runs out of money. All this from doing nothing more than lowering his fees by 1% each year.

Jim's next question to the planner is - how can this be? Wouldn't the mutual fund do better than the ETF - isn't that what the extra 1% is giving me - better results?

Jim is sold! So, how do I move my mutual funds into an index ETF he asks. His advisor responds, it's easier than you think, and with a wink and a flourish she adds...but that's an article for another day.

Comments

Post a Comment